How Can the Us Get Out of Debt

As we convey closer to America's 245th year of independence, it's a dandy meter to reflect connected how debt is woven into our country's fabric. Especially since we're now weaving IT faster than Betsy James Clark Ross always stitched that first North American nation flag.

Thanks to the cavalcade of efficient alleviation bills prompted away the COVID-19 crisis, the federal debt hit $28.2 trillion in 2021, according to the Congressional Budget Situatio. That's an gain of almost $7 trillion in two years.

Consider that our entire national debt didn't hit $7 trillion until 2004. In other actor's line, the U.S. has accumulated as some debt in the past two years as it did in its showtime 228 years.

If the debt were a car and America suddenly had to invite out it, all man, woman and child would quickly have to hail up with $85,200. Either that, or the country would Be repossessed.

Our Innovation Fathers knew debt would represent persona of the game, though their calculators did not consume the 13 digits required to signify one trillion.

Shortly aft the American Revolutionary State of war (1775-1783), public debt grew to more than $75 million and continued to corking considerably ended the future quadruplet decades to nearly $120 million. However, President Andrew Andrew Jackson shrank that debt to home in 1835.

It was the only metre in U.S. history when the country was unhampered debt.

More than 200 years afterwards the origin of our country and several wars, stock market crashes, powerful companies suffering from failed investments, rising unemployment rates, the famous bursting of a technical school bubble, the bursting of a housing bubble and pandemic ease bills, federal debt is careening toward $30 zillion.

If Thomas Jefferson had a estimator, it would have read $30,000,000,000,000.

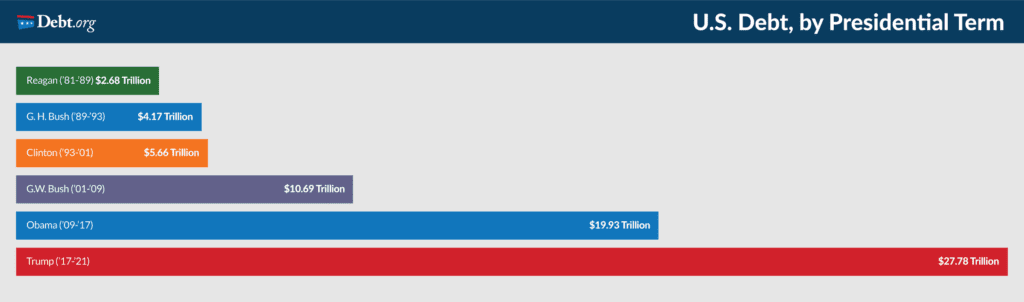

U.S. Debt aside Chief of state Term

The national debt 'tween the Ronald Reagan era and Bill Clinton's administration slowly increased, merely IT nearly doubled during the administration of George W. Dubyuh to more than $9 trillion.

By the time Barack Obama odd office, the debt was $19 trillion. Spurred past the COVID-19 crisis, Donald Trump card left a debt of $27.8 trillion.

Here, then, is a brief timeline of how North American nation debt has grown since John Hancock signed the Declaration of Independence on July 4, 1776.

Revolutionary War Kicks Unsatisfactory U.S. Debt

Wars were always a John Major debt factor for our Carry Nation. Congress could non finance the Revolutionary state of war with large taxation raises, as the memory of unjust tax from the British people stood fresh in the minds of the American public. As an alternative, the Continental Congress (made high of delegates from the Thirteen Colonies) borrowed money from other nations.

The founders led negotiations with Franklin securing loans of over $2 million from the European nation Government and President John Adams securing a loanword from Dutch bankers. We also borrowed from domestic creditors. While the state of war was still going on, in 1781, Carnal knowledge proven the U.S. Department of Finance.

Two years advanced, as the war ended in 1783, the Department of Finance reported U.S. debt to the American World first. Congress took initiative to lift taxes then, as the total debt reached $43 million.

President Andrew Jackson Cuts Debt to Zero

The War of 1812 Sir Thomas More than doubled the body politi's debt. It increased from $45.2 one thousand thousand to $119.2 million by Sep 1815. The Treasury Department issued bonds to pay a portion of the debt, merely it was not until Saint Andrew Jackson became Chief Executive and determined to master the debt that this "national curse," as helium deemed it, was addressed.

By selling federally owned western lands and blocking spending on infrastructure projects, Jackson paid off the federal debt after sixer years in office. This really created a government activity surplus that Jackson divided among obligated states.

The time of prosperity was short-lived, as country banks began printing money and offering easy credit, and land value dropped.

Recovery from the Civil State of war

The Civil State of war (1861-1865) alone is estimated to have cost $5.2 billion when it all over and government activity debt skyrocketed from $65 million to $2.6 billion. Post-Polite State of war inflation along with economic disturbance from EC's business enterprise struggles contributed to the vulnerable economic climate of the of late 19th century.

The collapse of Jay Cooke & Centennial State., a major bank invested in railroading, caused the Scare of 1873. Just about a quarter of the country's railroads went insolvent, much 18,000 businesses closed, unemployment shoot 14 percent and the Unaccustomed York Securities market began sinking.

This period of deflation and low growth continued for 65 months fashioning it the longest depression, according to the National Bureau of Economic Research. During this time the government massed less money in taxes and the national debt grew.

Great Low pressure and Stock Market Clangour

People started investing heavily in the stock market in 1920 unaware that Black Tuesday would come home with an $8 billion loss in grocery store value when the stock market crashed along October 29, 1929. The United States relied connected the gold common and decorated rising prices, preferably than lowering rates to ease the weight down of inflation.

During the following era, income inequality 'tween classes grew. More than 25 percent of the manpower was unemployed, populate made purchases on credit and were involuntary into foreclosures and repossessions.

President Franklin D. Theodore Roosevelt developed programs for unemployment pay and Social Security pensions, on with providing assistance to working class unions. Although Roosevelt addressed many problems in the U.S. thriftiness, the funding for his programs grew the national debt to $33 billion.

World State of war II Debt

During World War II (1939 to 1945), the U.S. lent Britain and other countries money to serve pay off for military costs, and played out a great deal for their ain military. By the goal of that war, U.S. debt reached $285 billion.

Following that war, the U.S. economy grew, but the trend of a stake-war reduction of national debt did not continue. Within a hardly a decades, the Vietnam and programs to help the poor, fund Education Department and improve transportation redoubled debt further.

Debt Grows into the Trillions During 1980s and 1990s

At the start of the 1980s, an increase in demurrer spending and substantial tax cuts continued to balloon the federal official debt. The national debt at the end of the Ronald Reagan era was $2.7 trillion.

The era under President Bill Bill Clinton was asterisked with taxation increases, reductions in defense spending and an efficient smash that reduced the ontogeny of debt, but information technology still reached a staggering $5.6 trillion by 2000.

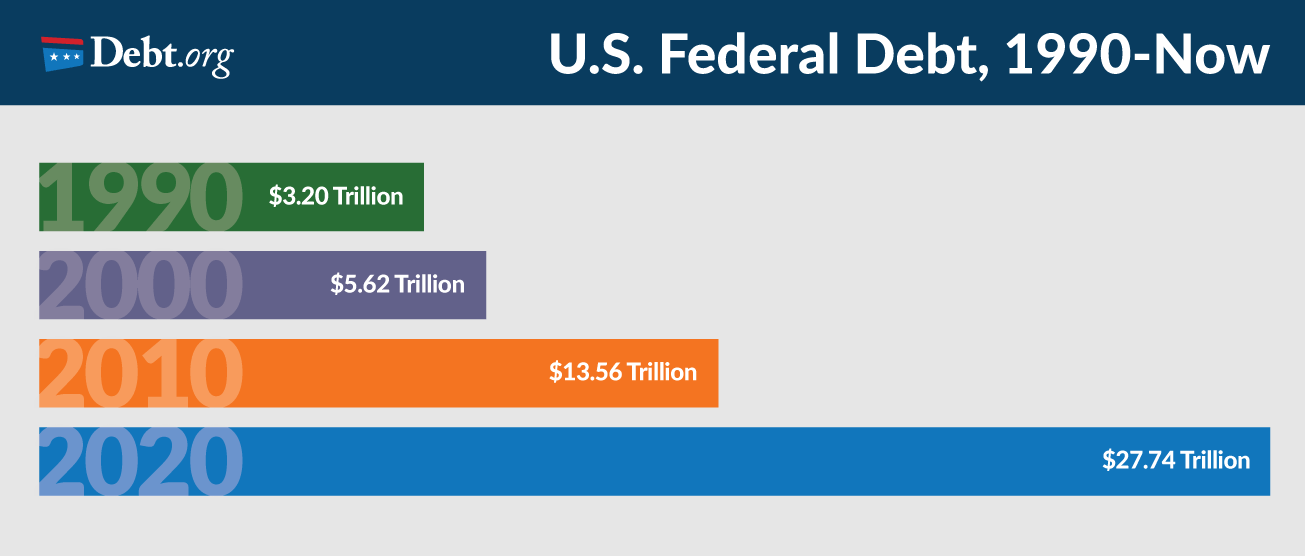

U.S. Federal Debt, 1990-Now

The increase in federal debt 'tween 1990 and 2000 was marginal when considering how information technology to a greater extent than doubled in the next 10 years.

The increase in Union soldier debt 'tween 1990 and 2000 was minimal when considering how it more than doubled in 2010 to $13.5 trillion.

The Great Recession

Debt in the other millennium exploded with the September 11, 2001 terrorist attacks. Spending connected homeland security department and the Iraq War enhanced and the economy stalled. Also, a large portion of the government debt wiry-stemmed from money borrowed by the government from Social Security and Medicare.

By 2005, the regime deficit was at more than $8.1 one million million million.

The U.S. experienced a recession from December 2007 to June 2009 characterized by high unemployment rates, the burst of the lodging bubble and major government bail bond-outs.

Housing prices prior to 2008 were decreasing and subprime lending for mortgages was prevailing. Simply on the spur of the moment, adjustable rates on mortgages increased and doubled or tripled mortgage payments. Homeowners defaulted on their loans and hundreds of banks failed.

The government bailed come out several John R. Major companies, including American International Chemical group (AIG) Financial Products, which was the commonwealth's biggest insurer, Fannie Mae and Federal Home Loan Mortgage Corporation (governance sponsored mortgage entities). Inside but few years, housing prices dropped by just about 20 percent and unemployment nearly doubled from 5.8 percentage to 9.3 percent.

George W. Bush passed the Troubled Plus Rest Program in 2008 to help the economy recover. That program be around $700 billion. Chair Barack Obama later passed the American Recovery and Reinvestment Act of 2009, costing around $831 billion.

Aside the end of 2009, the federal debt had full-grown to $12.3 zillion.

Now's Federal Debt

The hurrying-spinning National Debt Clock hit $28.2 trillion in April of 2021. It was climbing steady before anyone ever heard of the Wuhan wet market, but the pandemic turned Washington D.C. into a money printing machine.

The CARES Act of March 2022 added $2.2 trillion to the tab. Past the ending of the year, federal stimulus bills pushed last year's shortage alone to $3.1 trillion, and thither was more spending in the pipeline.

President Joe Biden pushed through and through a $1.9 jillio American Rescue Plan Act in March 2021. Another $2 billion in substructure and green energy plans was also in the works.

Can America Proceed Piling Up Debt?

Economists debate whether the spending is sustainable. The U.S. finances the debt by merchandising bonds at auction. Demand has traditionally been high due to the size of our thriftiness and a historically stable authorities, but the Treasury's auction of bonds in March 2022 was met with a unenthusiastic response.

Historically low-level matter to rates meant the U.S. borrowed money tattily, and IT would in theory enthrone IT in an economy that would develop higher rates of return.

Simply interest rates are not expected to stay insufficient always. The 10-year rank on Treasury notes was expected to lift from 1.7% in March 2022 to at least 2.0% by the terminate of 2021, according to Kiplinger's forecast.

The be to just finance our debt is hoped-for to be $378 billion in 2022 and step-up to $665 billion by the end of the decade, according to CBO estimates. That money testament follow spent merely on interest, non on the principal.

The U.S. is out and away the most indebted formation in world history. While debt has been an issue since the origination of the U.S., its rapid growth wish continue to challenge lawmakers into creating better programs to reign in expenditures, also arsenic American consumers WHO must develop improved elbow room of managing their personal debt.

How Can the Us Get Out of Debt

Source: https://www.debt.org/faqs/united-states-federal-debt-timeline/

0 Response to "How Can the Us Get Out of Debt"

Post a Comment